The instructional videos in this module walk you through the process of using and interpreting a simple but robust multi-product financial model for a business with multiple products or services.

COVID-19 Update: Here is advice on financial modelling from our How do I Raise Capital During COVID-19? Guide:

COVID-19 Update: Here is advice on financial modelling from our How do I Raise Capital During COVID-19? Guide:

Stay afloat.

- Don’t run out of cash. If you don’t have a business or organization, you won’t have any impact. The name of the game right now, as outlined in Mulago Foundation’s excellent resource: Lessons from those who’ve been here before, is simple: to stay in business as long as you can. You need to know EXACTLY what your cash runway is, or how many months of cash you have on hand or can generate to survive.

- Get friendly with Excel. Open Excel and start running scenarios to define your cash runway. Module 3 provides templates for cash projections and step-by-step guides on how to enter data and understand outputs. Get ready for some long Zoom calls with your CFO. No CFO? No worries, you can do this yourself. You need to run projections for revenues and expenses under various scenarios. What if the economic shutdown lasts for 3 more months? 6? 12? 18? Most experts we talked to say: start with the worst case. Model out what can happen to you if this continues for 18 months. Then backtrack and see what are the biggest costs that need to be cut in each scenario.

- Probe each input. What are revenues likely to look like during each of these periods? What growth or loss rates are likely for different products or segments of the business? Which customers will be affected and might cut contracts or stop purchasing from you? What costs can you cut or slow down? Ultimately, how much cash runway do you currently have? How far can you stretch it just based on internal actions? Try for a minimum cash runway of three months and your goal is to make decisions now every week or month about how to make it longer.

- Now is not the time for optimism. Consider removing all non-confirmed funding and revenue streams from your projections, even deals that were almost signed. Deal with what you have in hand.

- Prioritize. As you think about various revenue lines, prioritize the initiatives, products, or services that will deliver the most value. Define different kinds of value and use those as a guideposts.

Explore your options

- Consider staffing carefully. Think about how to handle staff costs. Could you do an across the board pay cut to save all jobs for a while? Which jobs could be changed into something that others value more during this period? For example, during the webinar, Anushka Ratnayake of MyAgro who is based in Senegal, explained she had made tough decisions about staff, reducing their global team (US-based) slightly to preserve local jobs. They also turned half of their 200 sales reps with great telephonic skills into “call center agents.”

- Go Macro. After you have a cash runway based on internal factors, Macro Scenario Planning is a very robust way of trying “what-if?” scenarios. In our experience, most entrepreneurs do not run enough of them. You want to organize your scenarios around major assumptions so that you have a list of concrete activities to take if certain things do end up happening. We really like this Macro Scenario Runway planner from a guide put together by a set of investors in India. The instructions include a matrix to help you methodically consider options.

- Engage stakeholders. You also want to think about scenarios not just with internal information, but with good external information. Now is the time to reach out to all your stakeholders, customers, suppliers, investors, board members, funders, lenders, peer collaborators, and ask them what they are predicting for their own business going forward. How do their plans or constraints affect yours?

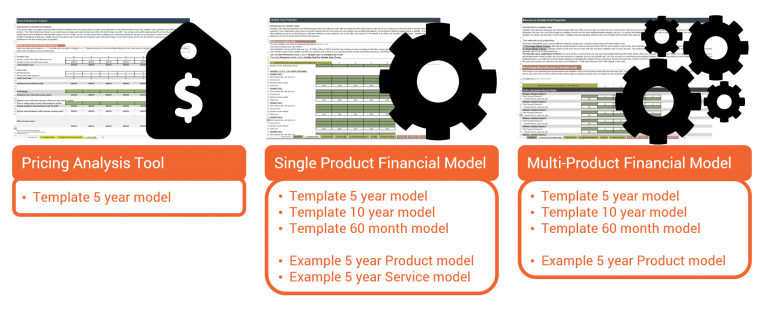

What template should I use?

If you have a simpler model with a single product or service, you can use the single-product model instead. For types of models, we offer different timelines to suit your needs: 5 year, 10 year, and 60 month. In addition, we have a pricing tool that any business can use to analyze how the price you set for a product or service impacts time to breakeven for that product or service.

We recommend watching the instructional videos to better understand the concepts and data needed for the model, and then visiting section 3.4 for the full list of template and example files available to you. A summary of that list is here: