Investors are never just capital providers – they are key stakeholders in your success. Once the deal is done and the funds have flowed, managing your ongoing relationship with investors becomes a priority. We’ve interviewed entrepreneurs and investors to find the best tips on how to manage relationships successfully with your investors, including guidance on:

Investors are never just capital providers – they are key stakeholders in your success. Once the deal is done and the funds have flowed, managing your ongoing relationship with investors becomes a priority. We’ve interviewed entrepreneurs and investors to find the best tips on how to manage relationships successfully with your investors, including guidance on:

- Being proactive

- How to communicate when something goes wrong

- How to handle missing a major milestone.

Download Managing Investors Through Good Times and Bad to get started putting good investor management practices into place and to prepare yourself now for any challenges you may face down the road.

Some of the methods of keeping potential investors engaged that you learned about in Module 8 can be applied to your current investors now that they’ve committed capital to your venture. In particular, it may be useful to revisit the guidance on writing investor update emails and developing dashboards in the Keeping Investors Engaged guide.

Many entrepreneurs come into negotiations with a hyper-focus on just one or two terms, often to the detriment of others that are equally important.

Many entrepreneurs come into negotiations with a hyper-focus on just one or two terms, often to the detriment of others that are equally important.

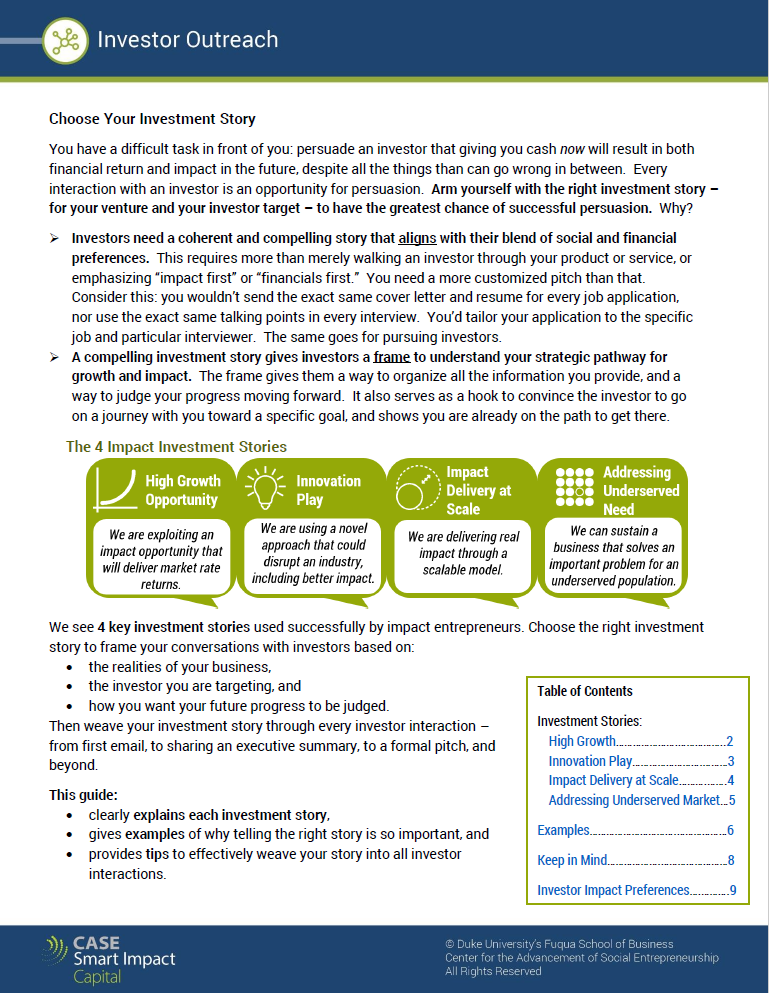

You’ve met and pitched the investor. There are three main answers you could hear: “Yes, I’m interested.” “Not until…” or “No.” Don’t just take those answers at face value though. The

You’ve met and pitched the investor. There are three main answers you could hear: “Yes, I’m interested.” “Not until…” or “No.” Don’t just take those answers at face value though. The  Your work isn’t done when the pitch is over! Even after a great first meeting or a fantastic pitch, it’s rare for an investor to give you a “yes” right away. You are still early in your relationship with the investor, and you need to be strategic about how you continue to keep that investor engaged with your venture. The

Your work isn’t done when the pitch is over! Even after a great first meeting or a fantastic pitch, it’s rare for an investor to give you a “yes” right away. You are still early in your relationship with the investor, and you need to be strategic about how you continue to keep that investor engaged with your venture. The

Now that you’ve prepared your investor pitch documents and connected with your investor targets, you’re ready for the pitch, right? Not so fast! You still have some preparation to do before you actually deliver your pitch to the next investor and make the most of this face-to-face time. Use our

Now that you’ve prepared your investor pitch documents and connected with your investor targets, you’re ready for the pitch, right? Not so fast! You still have some preparation to do before you actually deliver your pitch to the next investor and make the most of this face-to-face time. Use our  Investors are guaranteed to toss questions at you during the pitch, so don’t be caught off-guard! Our

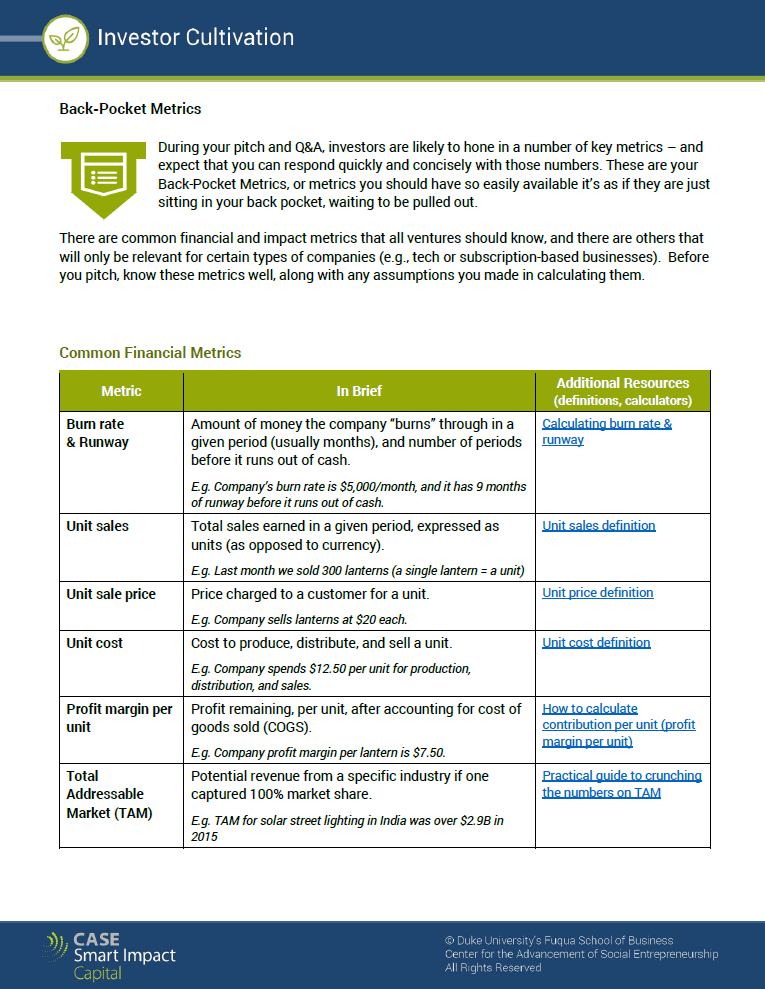

Investors are guaranteed to toss questions at you during the pitch, so don’t be caught off-guard! Our  There are a number of key business and impact metrics that investors could ask you about, and they’ll expect you to be able to produce those answers immediately – as though they are sitting right in your back pocket. Our

There are a number of key business and impact metrics that investors could ask you about, and they’ll expect you to be able to produce those answers immediately – as though they are sitting right in your back pocket. Our

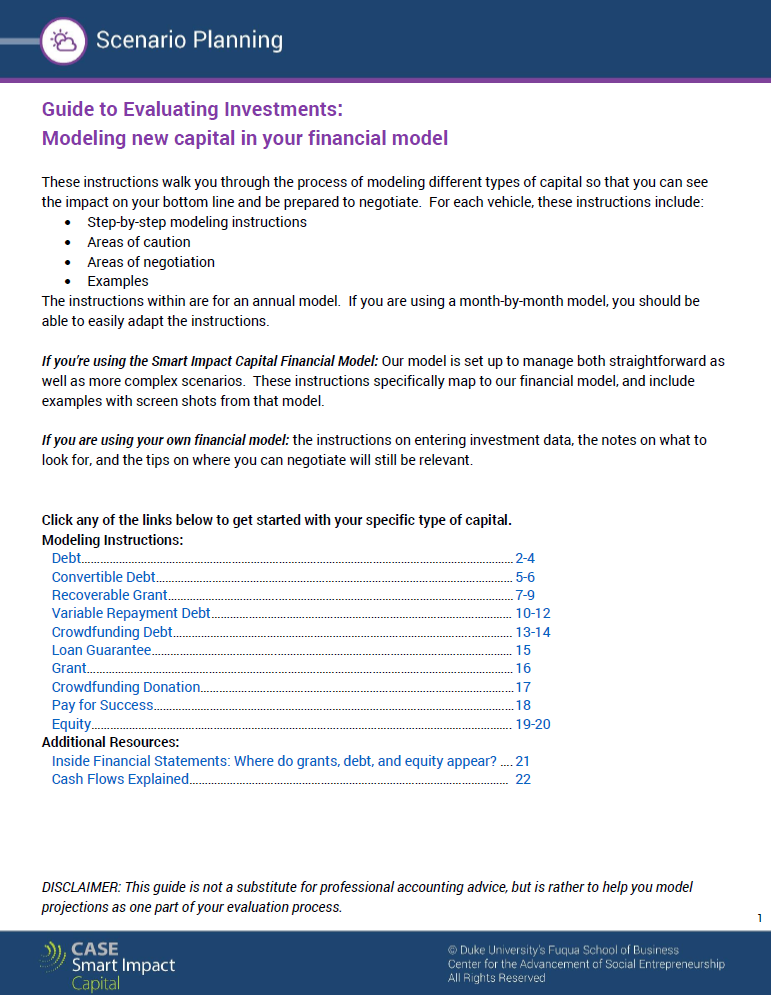

Before accepting an investment offer, you need to understand its impact on your financial model. No matter what investment vehicle you are considering, we have you covered. The

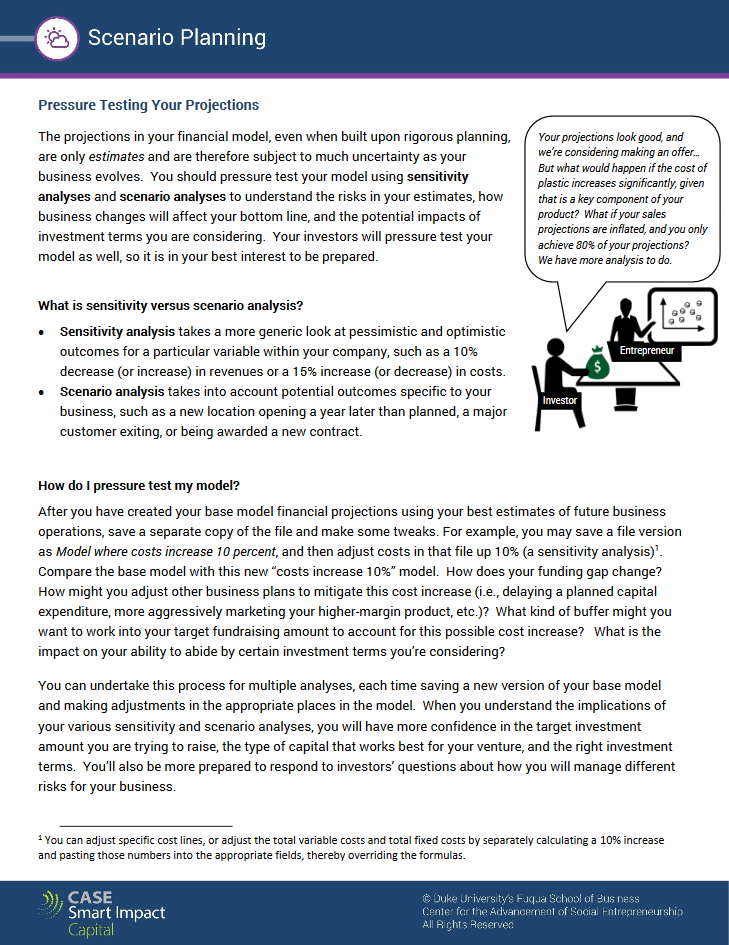

Before accepting an investment offer, you need to understand its impact on your financial model. No matter what investment vehicle you are considering, we have you covered. The  The projections in your financial model, even when built upon rigorous planning, are only estimates and are therefore subject to much uncertainty as your business evolves. What potential risks to your business should you consider before accepting the terms of an investment offer? Our

The projections in your financial model, even when built upon rigorous planning, are only estimates and are therefore subject to much uncertainty as your business evolves. What potential risks to your business should you consider before accepting the terms of an investment offer? Our